Recovery Loan Scheme (RLS)

Launched on 6th April 2021, RLS provides financial support to businesses across the UK as they recover and grow following the coronavirus pandemic.

You can apply to the scheme if Covid-19 has affected your business. You can use the finance for any legitimate business purpose including managing cashflow, investment and growth. However, you must be able to afford to take out additional debt finance for these purposes.

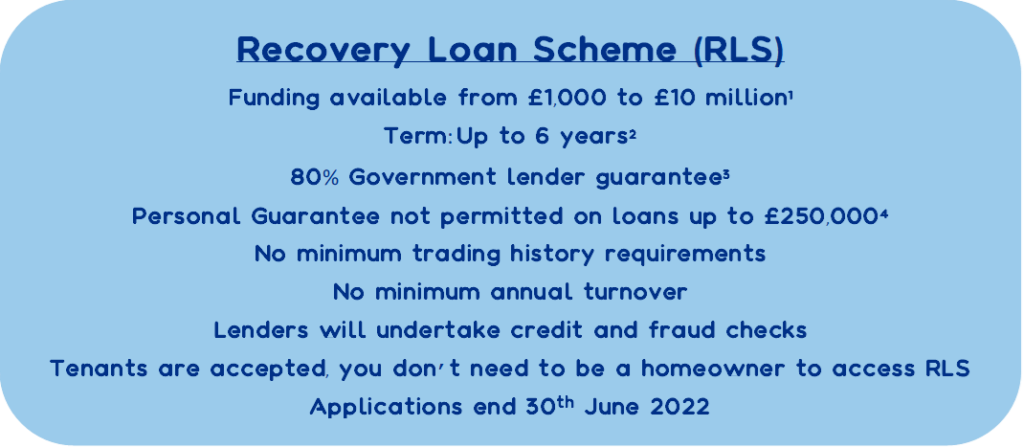

1 = Asset finance and invoice finance from £1000, loans and overdrafts from £25,001

2 = Loans and asset finance facilities: from three months up to six years. For overdrafts and invoice finance facilities: from three months up to three years.

3 = The scheme gives the lender a government-backed guarantee against the outstanding balance of the facility. As the borrower, you remain 100% liable for the debt.

4 = Personal guarantees are not permitted for facilities of £250,000 or less. Above £250,000 the maximum amount that can be covered under RLS is capped at a maximum of 20% of the outstanding balance of the RLS facility after the proceeds of business assets have been applied. No personal guarantees can be held over Principal Private Residences.

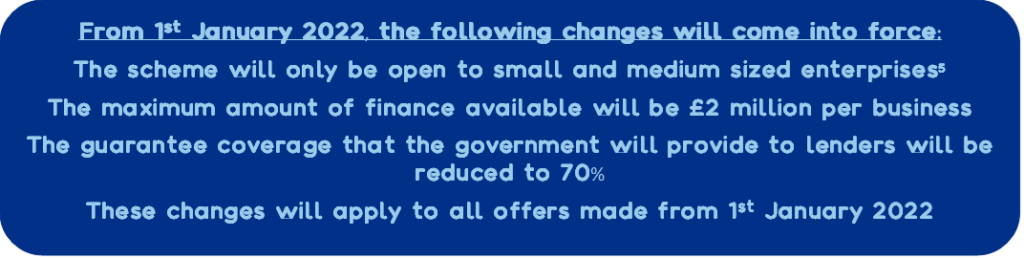

5 = Fewer than 250 employees and an annual turnover of under €50 million

Who is eligible?

If your business has already borrowed from any of the other coronavirus loan schemes (BBLS, CBILS or CLBILS) the RLS is still open to you, although the amount you have borrowed under an existing scheme may, in certain circumstances, limit the amount you may borrow under RLS.

Your business must:

- have been impacted by Covid-19 – you will need to confirm to the lender that you have been impacted by the coronavirus pandemic.

- be carrying out trading activity in the U.K.

- have a viable business proposition – your lender may disregard (at its discretion) any concerns over short-term to medium-term business performance due to the uncertainty and impact of Covid-19.

Credit and fraud checks

Lenders will be required to undertake standard credit, fraud, Anti-Money Laundering (AML) and Know Your Customer (KYC) checks for all applicants. When making their assessment, lenders may overlook concerns over short-to-medium term performance owing to the pandemic. The checks and approach may vary between lenders.

What a lender may need from you

When you apply for finance from RLS, you will need to provide certain evidence to show that you can afford to repay the RLS-backed facility. This is likely to include the following:

- Financial accounts

- Bank statements

- Management accounts

- Details of assets

- Business plan

Any business can approach a lender directly itself.

The following are not eligible under RLS:

- Banks, building societies, insurers and reinsurers (excluding insurance brokers)

- Public-sector bodies

- State-funded primary and secondary schools